FEATURE

Americans' Retirement Readiness

In the past, Americans looked at retirement savings as a "three-legged stool" comprised of equal parts Social Security, traditional "defined benefit" pension plans, and personal savings.

Today, the Social Security and pension plan "legs" are much smaller; Social Security replaces only about 40% of the average person's income, and many employers have frozen or terminated their pension plans.

To meet their retirement income needs, Americans must focus on growing personal savings and participating in "defined contribution" plans like 401(k)s and 403(b)s—which have become the fourth, and potentially biggest, leg of the stool.

Participate in your employer's retirement plan

One of the most important steps you can take to create a financially secure future is to participate in your employer's retirement plan. In addition to the convenience of automatic payroll deductions, a plan offers the opportunity to lower your current taxable income, defer taxes on your savings until you make a withdrawal, and give your account balance time to compound.

Set a savings goal

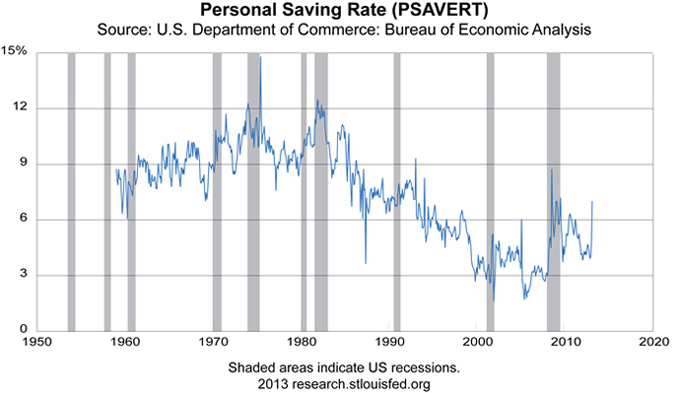

Financial planners generally recommend that you allocate 10% to 20% of your pay to savings. If that's not manageable today, pick an amount that you can comfortably save and commit to it. Every six months, revisit your savings rate and increase it by 1% or 2% until you reach your goal.

Lower your expenses

If you're currently unable to budget 10% to 20% of your income for savings, look for opportunities to lower your expenses. The changes you make don't have to be drastic; they can be as simple as shortening your annual vacation from two weeks to 10 days or going out to dinner once a week instead of twice.

Learn more

Your plan offers a variety of resources and tools to help you learn more about planning and saving for retirement.

- The Cost of Waiting:This short piece illustrates the importance of starting to save for retirement as early in your career as possible.

- The 1% Difference: This video outlines a relatively easy way to get on track toward meeting your retirement savings goal.

- Saving More: The Power of 1%: Use this tool after watching "The 1% Difference" video to get an idea of the impact that small increases to your contribution rate can have on your account balance over time.

- Retirement Plan Investing Basics: This piece provides an overview of key savings and investing concepts.

Connect with us: