FEATURE

This Is Not Your Father’s Retirement

Research shows that today’s retirees are depending more on personal savings and part-time work to finance their retirement. Will you?

As employers phase out traditional pension plans and legislators debate

the future of Social Security, guess

who's gained greater responsibility

for retirement planning.

As recently as 25 years ago, many employers sponsored traditional pension plans that guaranteed income to their employees in retirement, and some even provided subsidized health insurance to retirees. Social Security looked rock-solid, too; there was little talk of cutting benefits and increasing the full retirement age.

Today employers and employees typically share the responsibility for saving for retirement, and most retirees must obtain their own health insurance. The long-term viability of the Social Security system is also in question, as it’s currently underfunded.

On the other hand, with change comes opportunity. Whether retirement is 30 years away or right around the corner, there are steps you can take to help ensure that you’ll be prepared financially when the time comes.

If you’re just beginning your career…

Funds are tight for many people right after college, but you can ease into saving by contributing just 5% or 6% of your pay to your employer-sponsored retirement plan for a few months. (If your employer offers a match, save at least enough to earn every penny you're due.) As you get comfortable with the change in your take-home pay, increase your contribution rate by one or two percentage points. To quickly determine your “retirement outlook” and how much you may need to save to improve it, use the Retirement Outlook EstimatorSM.

Funds are tight for many people right after college, but you can ease into saving by contributing just 5% or 6% of your pay to your employer-sponsored retirement plan for a few months. (If your employer offers a match, save at least enough to earn every penny you're due.) As you get comfortable with the change in your take-home pay, increase your contribution rate by one or two percentage points. To quickly determine your “retirement outlook” and how much you may need to save to improve it, use the Retirement Outlook EstimatorSM.

Important: The projections or other information generated by Retirement Outlook EstimatorSM regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Results derived from the Retirement Outlook Estimator tool may vary with each use and over time. Please visit the Retirement Outlook Estimator for more information regarding the criteria and methodology used, the tool’s limitations and key assumptions, and other important information.

If you’re at the midway point in your career…

As our projected lifespans increase, so does the amount of time many of us will spend in retirement. If you haven’t reviewed your retirement savings goals in the past few years (or ever!), Transamerica’s Retirement Outlook EstimatorSM can help you see if you’re on track to meet your income needs or if you need to make some adjustments.

As our projected lifespans increase, so does the amount of time many of us will spend in retirement. If you haven’t reviewed your retirement savings goals in the past few years (or ever!), Transamerica’s Retirement Outlook EstimatorSM can help you see if you’re on track to meet your income needs or if you need to make some adjustments.

If you’re getting ready to retire…

The investment decisions you made five or ten years ago may not be appropriate once you’ve retired. If you’ve been investing aggressively, you may want to shift some of your assets to cash to fund day-to-day expenses. If you’ve been investing conservatively, consider investing a portion of your assets in stocks and long-term bonds to help ensure that you’re earning enough to beat inflation. Need help? Transamerica’s Retirement Readiness webinar can help you fine-tune your retirement-planning strategy.

The investment decisions you made five or ten years ago may not be appropriate once you’ve retired. If you’ve been investing aggressively, you may want to shift some of your assets to cash to fund day-to-day expenses. If you’ve been investing conservatively, consider investing a portion of your assets in stocks and long-term bonds to help ensure that you’re earning enough to beat inflation. Need help? Transamerica’s Retirement Readiness webinar can help you fine-tune your retirement-planning strategy.

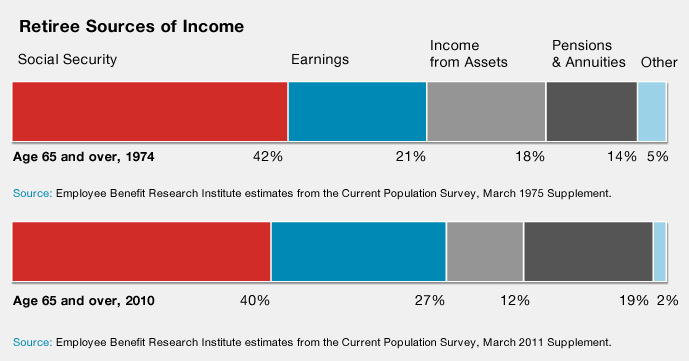

Then and Now

As the charts below illustrate, personal savings (“Income from Assets”) made up larger portions of retirees’ income in 1974 than they did in 2010, the latest year for which data is available. The Result: Today’s retirees depend more on earnings—from part-time jobs or small businesses, for example—than their predecessors did.

FAST FACTS

Rainy Day Savings Forecast

Are you saving for a rainy day? If not, you can start today with as little as $25.

MARKETWATCH Q&A

How Much Do You Know About Long-Term Care Insurance?

Learn the what, why, who, when, and how of long-term care coverage.

Connect with us: