FEATURE

What Type of Investor

Are You?

One of the key factors in successful investing is matching your investing style to your personality.

See if you can spot yourself in any of these common investor types.

The Nervous Investor

Do you sell an investment after a small drop in value, worried it will continue to fall? Do you check the value of your retirement account on a daily basis? If so, you may be a nervous investor. Nervous investors often invest too aggressively for their risk tolerance and, as a result, lose money by moving in and out of investments in response to short-term market shifts.

To take the edge off investing, reassess your risk tolerance and then adjust your current investment direction as needed. Once you've set your new asset allocation strategy, leave it alone for at least a year before you make any additional changes.

The Market Chaser

Do you watch investing shows to make sure you don't miss a “hot” opportunity? Do you wait for a sudden jump in a stock's value before you buy it? If so, you may be a market chaser.

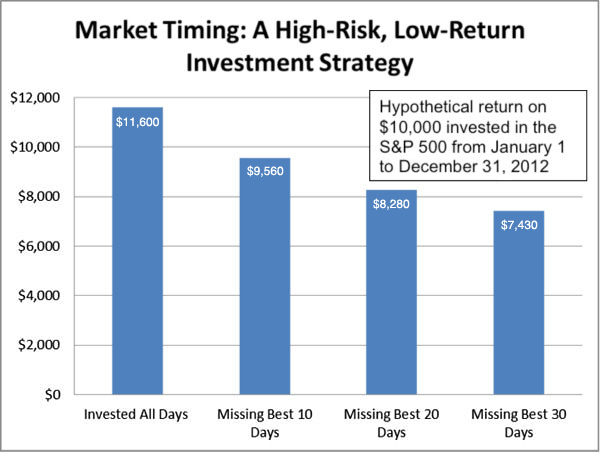

By waiting on the sidelines for an investment to do well, you may not only miss out on an increase in its value, but you may also end up paying top dollar when you finally decide to invest. Instead of chasing the market, identify the investments that have objectives similar to your own—whether that means slow and steady growth or short-term safety—and get in the game.

The Copycat

Do you ask your friends or relatives for investment advice? Buy a stock because a coworker can't stop talking about it? If so, you may be a copycat investor. Relying on advice from others, however well-intentioned they are, may not be a wise decision. Everyone's risk tolerance, time horizon and goals are unique, which is why we each need our own unique investment strategy.

Before making any investment decisions, take the time to research your options or hire a professional to help you. An advisor will take into account your ability to adapt to risk, your timing and your objectives before making a recommendation that suits you.

Still not convinced of the dangers of chasing performance? As this table shows, returns on bond and cash investments were fairly consistent over the last five years, but stock investments fluctuated dramatically during the same time period.

FAST FACTS

Retirement Readiness Trends

Feeling a little anxious about your future financial security? You're not alone.

SMARTMONEY Q&A

Extra Credit

School may be out for summer, but you can still earn high marks for good credit.

Connect with us: